All economic transactions in business are systematically recorded and managed so that the results of the transactions can be easily understood and found. Each transaction is recorded and managed through its respective method and each method can have rules, formats, etc. such as journal, subsidiary book, ledger, etc. When all the business transactions have been identified, measured, recorded, classified, etc., they are recorded in the trading account.

Only direct income and expenses are recorded in the trading account, if there is opening and closing stock then it is also recorded in it. All direct expenses and opening stock are recorded on the debit side and all direct income and closing stock are recorded on the credit side. The purpose of preparing trading accounts is to find out the gross profit or loss of the business.

Table of Contents

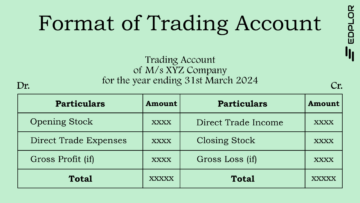

Format of Trading Account

The format of trading account is described below:

Trading Account

of M/s ABC Company

for the year ending 31st March 2024

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | xxxx | By Direct Trade Income* | xxxx |

| To Direct Trade Expenses | xxxx | By Closing Stock | xxxx |

| To Gross Profit (if) | xxxx | By Gross Loss (if) | xxxx |

| Total | xxxxx | Total | xxxxx |

1. General:

This includes parts outside the format such as account name, business name, date, etc. All these are part of the format, but they are written outside the format and with the help of them we get to know about the account, business, period, etc. For example, first the name of the account, such as trading account, followed by the name of the business to which the account belongs, and then the date. Generally, trading account is prepared at the end of the year, hence the closing date of the financial year is written on it.

Trading Account

of M/s ABC Company

for the year ending 31st March 2024

2. Debit and Credit:

The rule of double entry system applies to the trading account due to which it is divided into two parts, one debit and the other credit. Trading account is a nominal account due to which all the expenses are recorded on the debit side and all the income is recorded on the credit side. If opening and closing stock is available in the business, then opening stock is recorded on the debit side and closing stock is recorded on the credit side. Gross profit is recorded on the debit side and gross loss is recorded on the credit side.

| Debit Side | Credit Side |

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | xxxx | By Direct Trade Income* | xxxx |

| To Direct Trade Expenses | xxxx | By Closing Stock | xxxx |

| To Gross Profit (if) | xxxx | By Gross Loss (if) | xxxx |

| Total | xxxxx | Total | xxxxx |

3. Particulars:

Particulars are divided into two parts, one debit side and the other credit side. On the debit side opening stock, direct trading expenses, gross profit, etc. are recorded and on the credit side direct trading income, closing stock, gross loss, etc. are recorded. Direct expenses include purchases, inward freight, wages, royalty payments, factory rent, etc. and direct income includes sales, royalties received, license fees received, etc.

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | xxxx | By Direct Trade Income* | xxxx |

| To Direct Trade Expenses | xxxx | By Closing Stock | xxxx |

| To Gross Profit (if) | xxxx | By Gross Loss (if) | xxxx |

| Total | xxxxx | Total | xxxxx |

4. Amount:

The amount of the transaction (Heading) is written in this column. The heading is written in the particulars column and its amount is written in the amount column. For example, if the opening stock is Rs 1,00,000/- then opening stock will be written in the particulars column, and Rs 1,00,000/- will be written in the amount column. All transactions recorded in this format will be written in this manner.

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | 1,00,000/- | By Direct Trade Income* | 10,00,000/- |

| To Direct Trade Expenses | 5,00,000/- | By Closing Stock | 85,000/- |

| To Gross Profit | 4,85,000/- | ||

| Total | xxxxx | Total | xxxxx |

5. Total:

When all transactions have been recorded from both sides, they are totaled. If the total on the credit side is greater than the total on the debit side, it means the business has made a gross profit. Similarly, if the total on the debit side is more than the total on the credit side, it means that the business has made a gross loss. Both sides are made equal by recording gross profit or loss.

Trading Account

of M/s ABC Company

for the year ending 31st March 2024

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | 1,00,000/- | By Direct Trade Income* | 10,00,000/- |

| To Direct Trade Expenses | 5,00,000/- | By Closing Stock | 85,000/- |

| To Gross Profit | 4,85,000/- | ||

| Total | 10,85,000/- | Total | 10,85,000/- |

Read Also:

QNA/FAQ

Q1. What happens when the credit side exceeds debit side?

Ans: When the credit side exceeds the debit side the business has gross profit.

Q2. What is written in the particulars column of debit side?

Ans: Opening stock, direct trading expenses, gross profit etc. are written in the particulars column of debit side.

Q3. What happens when the debit side exceeds credit side?

Ans: When the debit side exceeds the credit side the business has a gross loss.

Q4. What is written in the particulars column of credit side?

Ans: Direct trading income, closing stock, gross loss, etc. are written in the particulars column of the credit side.

Q5. Write the name of the columns of the trading account format.

Ans: Following are the columns of the trading account format:

Debit Side

1. Particulars

2. Amount

Credit Side

1. Particulars

2. Amount