In every business, the management is interested in knowing about the financial performance of the business because future plans are made accordingly, for which the management prepares many types of reports in the business. Different formats can be used for each report prepared in business because each report is prepared for a different purpose, but all those reports are related to each other in some way or the other. One of these reports is the Profit and Loss Account Report.

There are many objectives or reasons for preparing profit and loss account of which the most important objective is to calculate profit and loss. A business can survive for a long time only if it is making profits. Profit and loss account is prepared taking data for a certain period. Profit and loss account records only indirect income and expenses and is prepared after the preparation of trading account as it requires gross profit or loss.

Table of Contents

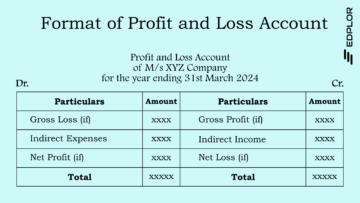

Format of Profit and Loss Account

The format of profit and loss account is described below:

Profit and Loss Account

of M/s ABC Company

for the year ending 31st March 2024

| Particulars | Amount | Particulars | Amount |

| To Gross Loss (if) | xxxx | By Gross Profit (if) | xxxx |

| To Indirect Expenses | xxxx | By Indirect Income | xxxx |

| To Net Profit (if) | xxxx | By Net Loss (if) | xxxx |

| Total | xxxxx | Total | xxxxx |

1. General:

It includes all the external elements like business name, account name, period, etc., and helps in understanding about the account/report. All these elements are part of the format, but they are written outside the format. Without these, the format is incomplete as these elements tell which business the report pertains to, what is the name of the report, what period of data is used in the report, etc. Whenever the Profit and Loss Account is drafted these elements are written first.

Profit and Loss Account

of M/s ABC Company

for the year ending 31st March 2024

2. Debit and Credit:

The format of profit and loss account is divided into two parts, a debit part and a credit part, this is because of the double entry system. It is a nominal account due to which all the expenses, losses, etc. are recorded on the debit side, and all the income, profits, gains, etc. are recorded on the credit side but net profit is written on the debit side and net loss is written on the credit side. Both sides have the same columns, one is the particulars column, and the other is the amount column.

| Debit Side | Credit Side |

| Particulars | Amount | Particulars | Amount |

| To Gross Loss (if) | xxxx | By Gross Profit (if) | xxxx |

| To Indirect Expenses | xxxx | By Indirect Income | xxxx |

| To Net Profit (if) | xxxx | By Net Loss (if) | xxxx |

| Total | xxxxx | Total | xxxxx |

3. Particulars:

This column is on both the debit side and the credit side. The name of the transaction (Head) is recorded in this column. The names of all debit transactions are recorded on the debit side particulars column and the names of all credit transactions are recorded on the credit side particulars column. On the debit side gross loss, expenses, net profit, etc. are recorded and on the credit side gross profit, income, net loss, etc. are recorded. Only indirect expenses and indirect income are recorded in this account.

| Particulars | Amount | Particulars | Amount |

| To Gross Loss (if) | xxxx | By Gross Profit (if) | xxxx |

| To Indirect Expenses | xxxx | By Indirect Income | xxxx |

| To Net Profit (if) | xxxx | By Net Loss (if) | xxxx |

| Total | xxxxx | Total | xxxxx |

4. Amount:

The amount of the transaction (head) is recorded in this column. The amount of all debit transactions is recorded on the amount column of the debit side and the amount of all credit transactions is recorded on the amount column of the credit side. For example, the indirect expenses are Rs 2,00,000/-, in this case, the head of indirect expenses will be recorded on the particular column of the debit side, and the amount of that transaction Rs 2,00,000/- will be recorded on the amount column of the debit side.

| Particulars | Amount | Particulars | Amount |

| To Indirect Expenses | 2,00,000/- | By Gross Profit | 4,85,000/- |

| To Net Profit | 3,00,000/- | By Indirect Income | 15,000/- |

| Total | xxxxx | Total | xxxxx |

5. Total:

This section is given last in the format as it is used only when all the transactions have been recorded. This section helps to determine whether the business has made a profit or a loss. If the total of the debit side is more than the total of the credit side then it means that the business has made a loss, similarly, if the total of the credit side is more than the total of the debit side then it means that the business has made a profit. When profit or loss is recorded, the total of both sides become equal.

Profit and Loss Account

of M/s ABC Company

for the year ending 31st March 2024

| Particulars | Amount | Particulars | Amount |

| To Indirect Expenses | 2,00,000/- | By Gross Profit | 4,85,000/- |

| To Net Profit | 3,00,000/- | By Indirect Income | 15,000/- |

| Total | 5,00,000/- | Total | 5,00,000/- |

Read Also:

QNA/FAQ

Q1. When will it be said that the business has made a profit?

Ans: When the credit side of the profit and loss account is exceeds the debit side.

Q2. What happens when the debit side of the profit and loss account exceeds the credit side?

Ans: When the debit side of the profit and loss account exceeds the credit side the business made a loss.

Q3. When will it be said that there has been a loss in the business?

Ans: When the debit side of the profit and loss account exceeds the credit side.

Q4. What happens when the credit side of the profit and loss account exceeds the debit side?

Ans: When the credit side of the profit and loss account exceeds the debit side the business makes profit.

Q5. The format of profit and loss account is divided into two parts, is it true?

Ans: Yes, it is true, the format of profit and loss account is divided into two parts one debit part and other credit part.

Q6. Write the names of the columns of profit and loss account format.

Ans: Following are the columns of the profit and loss account format:

Debit Side

1. Particulars

2. Amount

Credit Side

1. Particulars

2. Amount