Whatever goods are available in the market, they all have a price on the basis of which the transaction of those goods takes place. The price of an item can be determined only when its cost is known because unless it is known how much it costs to make that item, the price of that item cannot be determined correctly. Incorrect pricing of goods can directly affect the business, which is why the manufacturing account is prepared to determine the price of goods in the business.

It is not mandatory to prepare a manufacturing account, it completely depends on the business whether they want to prepare it or not. There is no fixed format for preparing a manufacturing account, it can be prepared in any format but whatever format is prepared it should be based on the concept of a manufacturing account. Apart from the manufacturing account, there are many other concepts for calculating the cost of goods.

Table of Contents

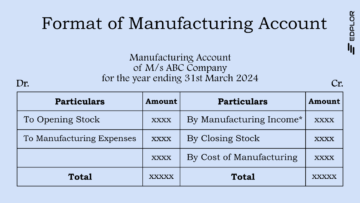

Format of Manufacturing Account

The format of manufacturing account is described below:

Manufacturing Account

of M/s ABC Company

for the year ending 31st March 2024

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | xxxx | By Manufacturing Income* | xxxx |

| To Manufacturing Expenses | xxxx | By Closing Stock | xxxx |

| By Cost of Manufacturing | xxxx | ||

| Total | xxxxx | Total | xxxxx |

1. General:

It contains all the external elements of the manufacturing account format and plays a very important role in understanding the format. With its help it becomes easy to understand which report it is, which business it pertains to, what is the period of the data, etc. All these elements are written before using the manufacturing account format, and then further processing is started.

Manufacturing Account

of M/s ABC Company

for the year ending 31st March 2024

2. Debit and Credit:

Manufacturing account format is divided into two main sides/parts one is the debit side and the other is the credit side. Both sides have the same columns, like particulars and amount. Manufacturing Account is a nominal account due to which all manufacturing expenses are recorded on the debit side and all income arising during manufacturing is recorded on the credit side. Opening stock is recorded on the debit side and closing stock and cost of manufacturing are recorded on the credit side.

| Debit Side | Credit Side |

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | xxxx | By Manufacturing Income | xxxx |

| To Manufacturing Expenses | xxxx | By Closing Stock | xxxx |

| By Cost of Manufacturing | xxxx | ||

| Total | xxxxx | Total | xxxxx |

3. Particulars:

Particulars columns are divided into two sides one is the debit side and the other is the credit side. All debit material is recorded on the debit side like opening stock, manufacturing expenses, etc. and all credit material is recorded on the credit side like income during manufacturing, closing stock, cost of manufacturing, etc. With its help, the particulars and its amount are recorded separately which helps in keeping the manufacturing account clean.

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | xxxx | By Manufacturing Income | xxxx |

| To Manufacturing Expenses | xxxx | By Closing Stock | xxxx |

| By Cost of Manufacturing | xxxx | ||

| Total | xxxxx | Total | xxxxx |

4. Amount:

In this column, the amount of particulars is written, and it is also divided into two sides, one debit side and the other credit side. All debit amounts such as the amount of opening stock, amount of manufacturing expenses, etc. are written on the debit side, and all credit amounts such as the amount of closing stock, amount of cost of manufacturing, etc. are written on the credit side. For example, if the opening stock is Rs 10,000/- then the opening stock will be recorded in the particulars column, and Rs 10,000/- will be recorded in the amount column.

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | 10,000/- | By Manufacturing Income | 1,000/- |

| To Manufacturing Expenses | 50,000/- | By Closing Stock | 15,000/- |

| By Cost of Manufacturing | 44,000/- | ||

| Total | xxxxx | Total | xxxxx |

5. Total:

The total section is also divided into two sides one debit side which is called total of debit amounts and the other credit side which is called total of credit amounts. After all the transactions are recorded in the manufacturing account, both the amount columns are added. Whatever amount remains on the credit side after adding both the amount columns is called the cost of manufacturing. The cost of manufacturing is transferred to the trading account for further processing.

| Particulars | Amount | Particulars | Amount |

| To Opening Stock | 10,000/- | By Manufacturing Income | 1,000/- |

| To Manufacturing Expenses | 50,000/- | By Closing Stock | 15,000/- |

| By Cost of Manufacturing | 44,000/- | ||

| Total | 60,000/- | Total | 60,000/- |

Read Also:

QNA/FAQ

Q1. Is manufacturing account divided into debit and credit?

Ans: Yes, manufacturing account is divided into debit and credit.

Q2. Do manufacturing accounts have to be prepared in a specific format?

Ans: No, manufacturing account can be prepared in any format.

Q3. Is it mandatory to prepare manufacturing account?

Ans: No, it is not mandatory to prepare manufacturing account.

Q4. Are the particulars and amount columns in the manufacturing account divided into two parts?

Ans: Yes, particulars and amount columns in the manufacturing account are divided into two parts, one is the debit part, and the other is the credit part.

Q5. Write the name of the column of the manufacturing account.

Ans: Following are the names of the columns of the manufacturing account:

Debit Side

1. Particulars

2. Amount

Credit Side

1. Particulars

2. Amount