Managing transactions in business is a challenging task as a small mistake can affect the entire accounting process. Businesses which have more transactions are difficult to manage than businesses with fewer transactions, that is why accounting system is used to manage the transactions in business. Accounting system helps to systematically manage the economic transactions taking place in a business as it involves many rules, formats, concepts, etc. One format in the accounting system is that of ledger account.

The format of ledger account is prepared according to the concept of ledger and there is no fixed format of the ledger account but whatever format will be prepared should be as per the concept of ledger. Using the concept of ledger the transactions are classified according to their nature and a separate space is given for each nature which is known as a ledger account. Ledger account is used after journal because journal entries are passed in it.

Table of Contents

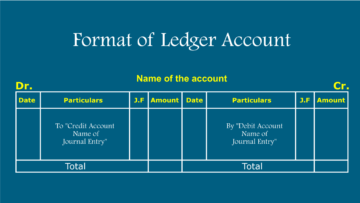

Format of Ledger Account

The format of ledger account is described below:

Name of the Account

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| To “Name of the credit account in journal entry” | By “Name of the debit account in journal entry” | ||||||

| Total | Total |

1. General:

All the external elements of the format come under it like account name, debit side and credit side indicators, and other external elements, etc. These are all parts of the format, and it helps in understanding the account and format like What does the account belong to, which is the debit side of the account, and which is the credit side, etc. If this part is omitted, then it will become difficult to understand the account which will hinder the management of transactions.

2. Debit and Credit:

The ledger account format is divided into two sides/parts, one debit side and the other credit side. On the debit side of the ledger account are recorded those transactions which debit the ledger account and on the credit side are recorded those transactions which credit the ledger account e.g. the credit transaction of a journal entry is recorded on the debit side of the ledger account and the debit transaction of the journal entry is recorded on the credit side of the ledger account. Which side of the ledger account will be positive and which side will be negative depends on the nature of the ledger account or the nature of the transaction.

3. Date:

The date of transaction is recorded in this column and it is also divided into two sides, one debit side and the other credit side. On the debit side, only the date of the debit transaction is recorded and on the credit side, only the date of the credit transaction is recorded. Any type of date format can be used but the condition is that the date should be understandable. This column helps to understand when the transaction recorded in the ledger account occurred.

4. Particulars:

The name of the account is written in this column and it is also divided into two sides, one debit side and the other credit side. On the debit side, only debit transactions are recorded and on the credit side only credit transactions are recorded, but the opposite transaction name is recorded for reference.

- The debit account name of the journal entry is recorded on the credit side of the ledger account.

- The credit account name of the journal entry is recorded on the debit side of the ledger account.

5. Journal Folio:

Journal Folio means the page number of the journal entry book, in this column the page number of the journal entry book is written where the journal entry of the transaction is passed. This is exactly like the format of journal entry because in the format of journal entry, the page number of the ledger account book is written and in the format of ledger account the page number of the journal entry book is written. With its help, both remain connected to each other, which makes their management easier.

6. Amount:

In this column, the amount of the transaction is recorded and it is also divided into two sides, one is the debit side which is also known as the debit amount column and the other is the credit side which is also known as the credit amount column. On the debit side, only the amount of debit transaction is recorded, and on the credit side, only the amount of credit transaction is recorded. This column also helps in understanding the amount of debit transactions and the amount of credit transactions.

7. Total:

After all the transactions are recorded in the ledger account, the amounts on both sides of the amount column are added and that amount is written in the total section. If after recording all the transactions both sides of the amount column of the ledger account are not equal, then balance carried down entry is passed which helps in equalizing both sides. The balance carried down entry is considered as the closing balance and is reversed in the next period to the balance brought down and is considered as the opening balance.

Read Also:

QNA/FAQ

Q1. Why is the ledger account format used?

Ans: The ledger account format is used to systematically record classified transactions at one place.

Q2. When does balance carry down entry used?

Ans: When the total of the amount column on both sides of the ledger account does not match.

Q3. When is the balance brought down entry used?

Ans: When balance carry down entry is used.

Q4. What does journal folio mean?

Ans: Journal Folio mean the page number of the journal entry book.

Q5. Write the name of the column of the ledger account format.

Ans: Following are the names of the columns of the ledger account format.

Debit Side

1. Date

2. Particulars

3. Journal Folio (J.F.)

4. Amount

Credit Side

1. Date

2. Particulars

3. Journal Folio (J.F)

4. Amount