In accounting, to manage the transactions properly and get the correct result, the tasks are divided into different parts according to their nature which is also called the process of accounting and under this process comes the recording stage or part in which journal entries have to be passed in a book by using the concept of journal and this book is known as journal book.

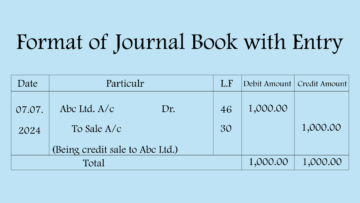

A format is made or created for passing entries in a journal book, which helps in recording the entries systematically. The format can be made in any form, but it should not violate the concept of the journal. Generally, the format of a journal book consists of five columns like date, particulars, ledger folio, debit amount, and credit amount. Note: Due to increasing technology, manual work is changing.

Table of Contents

Format of Journal Book

The format of the journal book is described below:

| Date | Particulars | L. F. | Debit Amount | Credit Amount |

| Account Name (Debit & Credit) with Narration (Description) | xxxxx | xxxxx | ||

| Total | xxxxx | xxxxx |

1. General:

All the external elements of the format or that help in understanding the format are included in it like who the book relates to, the name of the business, the period, and other elements, etc. This is very beneficial for businesses that use subsidiary books because they use different books for different types of transactions, and it helps in understanding those books.

2. Date:

In this column, the date of the transaction is entered, and the date can be entered in any form, but it should be understandable. This column helps in understanding when the transaction took place. Usually, entries are passed daily in the journal book, so the date of the transaction and the date of entry passed are the same.

3. Particulars:

In this column, the debit and credit accounts related to the transaction are entered. After entering the debit account, the word “Dr.” is used and before entering the credit account, the word “To” is used. These words are used as indicators so that the debit and credit accounts can be identified. When the debit and credit accounts related to the transaction are entered, some information related to that transaction is written below it, which is known as the narration.

| Date | Particulars | L. F. | Debit Amount | Credit Amount |

| xxxx | Bank A/c Dr. To Sales A/c (Being sale) | xxxxx | xxxxx | |

| Total | xxxxx | xxxxx |

4. Ledger Folio:

Ledger folio means the page number of the ledger book. In this column, the page number of the ledger book is written where the account related to the journal entry is prepared. For example, if the sales account is prepared on page number 30 in the ledger book, then after recording the transaction in the journal book, 30 will be written in the ledger folio column. Ledger folio helps in understanding where the account related to this entry is present in the ledger book.

| Date | Particulars | L. F. | Debit Amount | Credit Amount |

| xxxx | Bank A/c Dr. To Sales A/c | 20 30 | xxxxx | xxxxx |

| Total | xxxxx | xxxxx |

5. Debit Amount:

In this column, the amount of the debit account is written, and the debit amount is equal to the credit amount. The amount of the credit account is entered in the credit amount column. The amount of the debit account is entered before the amount of the credit account. Having separate columns for debit and credit accounts makes it easier to manage transactions.

6. Credit Amount:

In this column, the amount of the credit account is entered and the credit amount is equal to the debit amount. The amount of the credit account is entered after the amount of the debit account. If the column name is not mentioned, then an account indicator can be used like credit transaction is entered with “To” which shows that all the accounts entered with “To” are credit accounts and the amount written in front of them is also credit.

7. Total:

In this section, the sum of the debit account amount and the credit account amount is written. Both the debit amount and the credit amount are equal to each other because the journal entry is based on the double entry system. The sum of the debit amount is recorded at the end of the debit amount column and the sum of the credit amount is recorded at the end of the credit amount column. If the sum of both sides is equal, then it is assumed that the journal entries have been recorded correctly.

Read Also:

QNA/FAQ

Q1. Does the format of the journal book help in recording journal entries systematically?

Ans: Yes, the format of the journal book helps in recording the journal entries systematically

Q2. What is Ledger Folio?

Ans: Ledger folio means the page number of the ledger book.

Q3. Does Ledger Folio help in locating the account?

Ans: Yes, Ledger Folio helps in locating the account.

Q4. If the sum of both the amount column is equal then what will be considered?

Ans: If the sum of both the amount columns is equal then it will be considered that the journal entries have been recorded correctly.

Q5. Write the column name of the journal book format.

Ans: The following are the column names of the journal book format:

1. Date

2. Particulars

3. Ledger Folio

4. Debit Amount

5. Credit Amount